TakeProfitTrader is a futures proprietary trading firm offering prospective traders the opportunity to partake in futures trading without putting their personal capital at risk. Based in Orlando, Florida, the firm provides a wide range of features that distinguish it from other leading prop firms.

Take Profit Trader is a futures proprietary trading firm offering prospective traders the opportunity to partake in futures trading without putting their personal capital at risk. Based in Orlando, Florida, the firm provides a wide range of features that distinguish it from other leading prop firms.

Traders have complimentary access to a number of platforms for executing trades, including NinjaTrader, Trading View, R | Trader Pro, Quantower and Tradovate. Renowned for their varied functions, from technical analysis and charting to backtesting and automated trading, these platforms provide traders with a comprehensive set of tools to effectively navigate the markets.

Traders partnering with Take Profit Trader Prop firm can specify how much capital they wish to manage. In order to gain access to a funded account and start with real capital, traders have to demonstrate their trading abilities, achieving a set profit target and adhering to predefined risk rules.

Take Profit Trader distinguishes itself by tailoring its platform and services to prioritise the trader’s needs and enhance their trading experience. Among the firm’s most distinctive features are the speed with which traders can progress to funded accounts, instant withdrawals, pro account resets and the efficient live support.

Take Profit Trader have streamlined the process for attaining funding. Traders simply need to select a funded account that will meet their needs and demonstrate they have the requisite trading abilities. Those who succeed will quickly be able to start trading with real capital and retain a significant portion of the profits they generate. We breakdown the process below:

Traders should select an evaluation program that aligns with their trading preferences. Once you enrol, you’ll receive a designated amount of capital for both your Test and PRO Accounts. The futures prop firm’s robust risk management protocols are designed to ensure disciplined trading practices. While all trading carries inherent risk, any losses incurred on the PRO Account are absorbed by Take Profit Trader Funding rather than the trader.

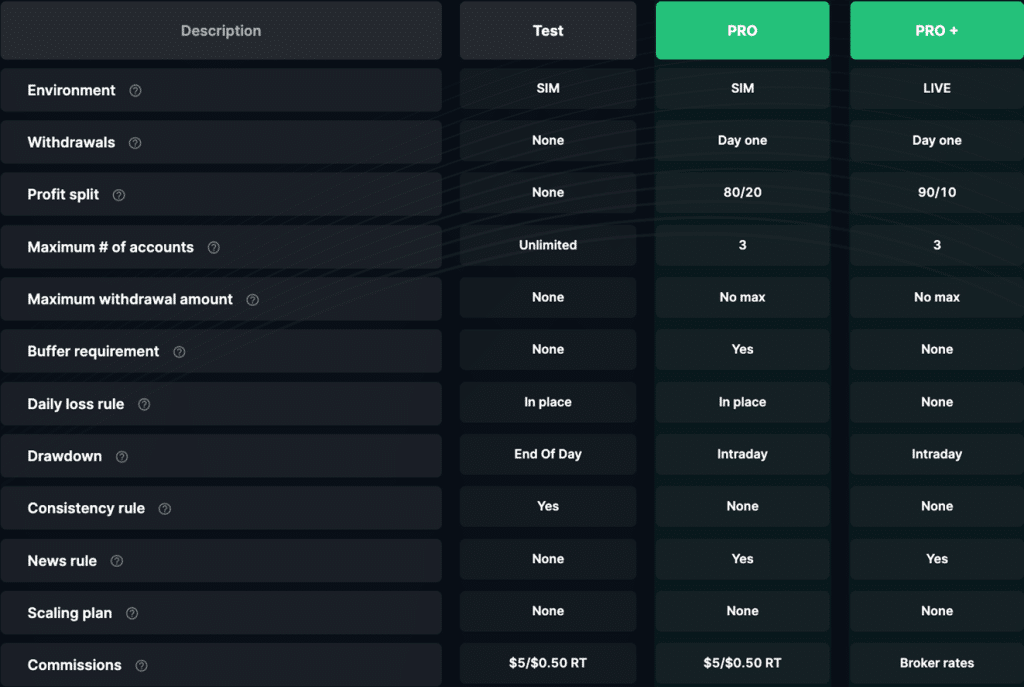

The table below compares the features and rules for Test, PRO and PRO+ Accounts.

Take profit prop firm Test accounts are akin to a trial period for a PRO account, allowing Take Profit Trader to evaluate your trading skills. When you join the firm, these accounts will be displayed as the default option.

To access your Test accounts and see how they’re performing, visit the Control Centre and click on an account to display its trading dashboard. If you’ve reset an account, you’ll find it beneath the first account listed in the Control Centre.

Traders who successfully complete a trading test qualify for a Take Profit prop firm PRO account, from which they can derive real income. There is a PRO account tab at the top of the Take Profit Trader website, which enables you to easily switch between your Test and PRO accounts. The credentials and licence key for your PRO account are the same as for your Test account.

Each PRO account can be reset three times, making the process more convenient and efficient for traders by removing the need to take the test repeatedly.

The instruments you can trade with Take Profit Trading include:

Take Profit Trading offers traders a compelling platform. The range of account sizes on offer, combined with a generous profit-sharing framework and supportive infrastructure, create a user-friendly environment conducive to profitable trading. As such, the firm is worthy of consideration from traders of all experience levels, from newcomers to the industry through to experienced professionals.

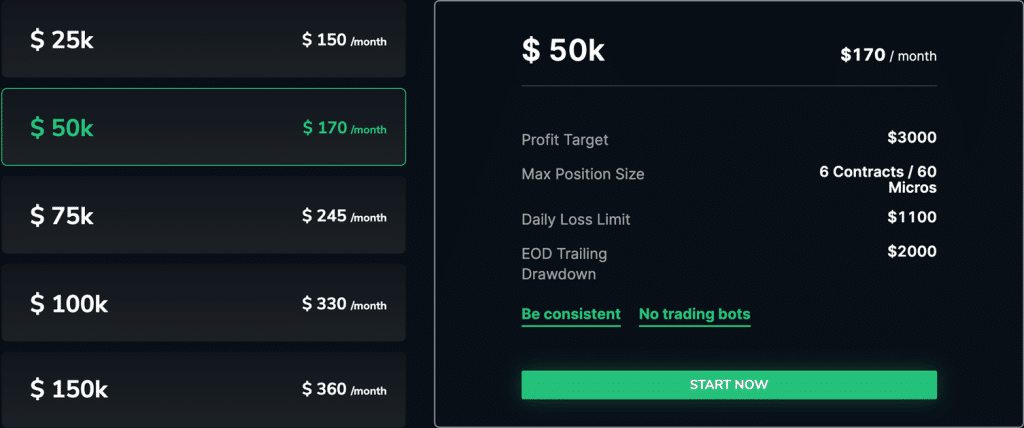

Currently, Take Profit Funding provides a variety of account sizes in line with the offerings of other futures trading funded programs. Monthly subscription fees start at $150 and go up to $360 based on account size, which spans from $25,000 to $150,000. PRO Accounts allow for up to three resets and entail a one-off fee, eliminating the requirement for recurring payments.

We will update this section regularly as the firm expands its offerings to include other asset classes.

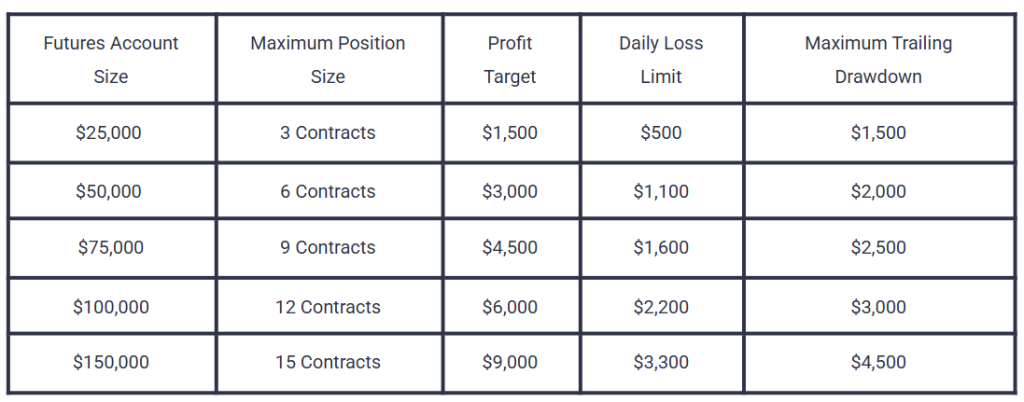

Each account size has its own profit target, which are plausibly realisable and similar to those found elsewhere in the industry. Below we detail the profit target and maximum contract number for each account size:

Managing risk effectively is a fundamental part of trading profitably. One of the key criteria for risk management is the daily loss cap. Take Profit Trader has set fair caps that encourage traders to trade responsibly. These are detailed in the table below.

One oversight in risk management that arises commonly is neglect of the EOD trailing drawdown. Take Profit Trader have streamlined this rule for Test accounts, so that it is calculated at the end of each trading day rather than during the course of individual trades. The table below lists the EOD trailing drawdown for each account size, followed by an illustration of how the EOD trailing drawdowns work.

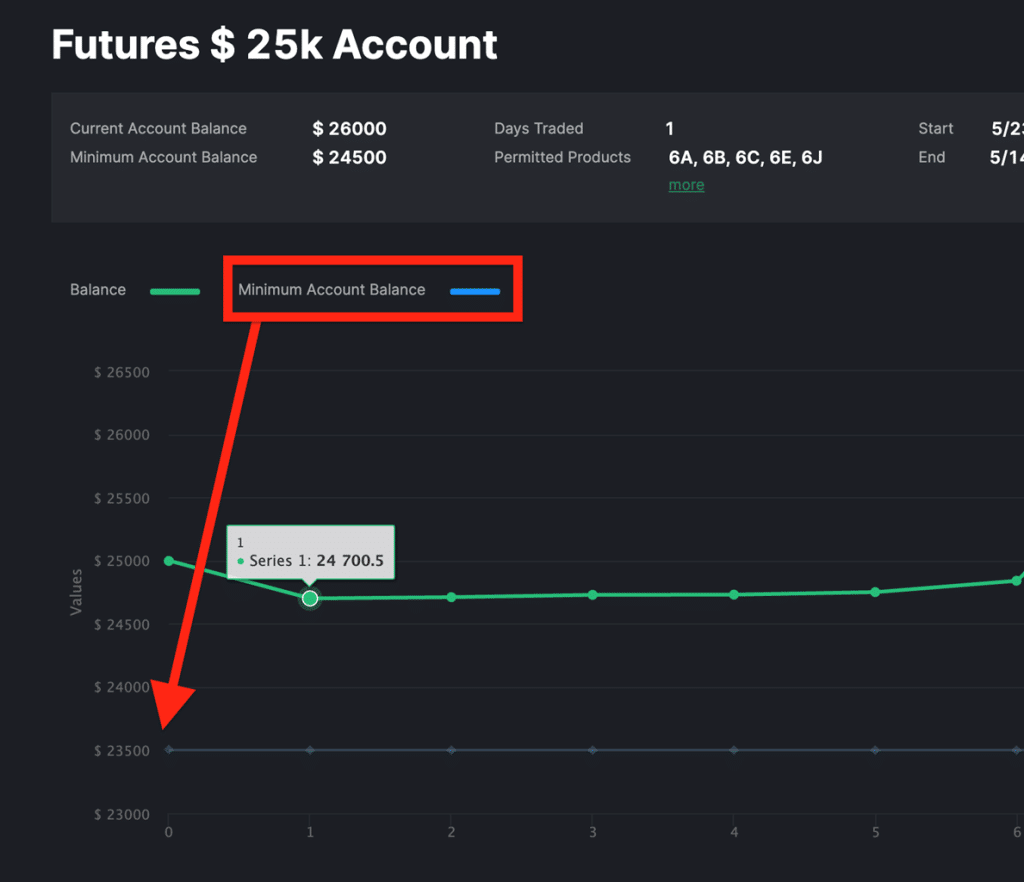

In the Control Center, you will see the maximum trailing drawdown built into the metric “Minimum account balance”.

The diagram depicts a $25,000 account. With the maximum trailing drawdown set at $1,500 for a $25,000 account, the minimum account balance starts at $23,500 (as $25,000 – $1,500 = $23,500).

The mechanism is known as “trailing” because the minimum account balance “trails” the account balance as it increases. For example, if you earn $1,000 on your first trading day, your balance will rise to $26,000 while your minimum account balance adjusts to $24,500.

In this scenario, the minimum account balance will persistently “trail” $1,500 behind your highest EOD account balance until it reaches $25,000. Once it aligns with the account’s starting point, it ceases to “trail” your account higher.

The illustration below should make this clearer.

Take Profit Trader’s profit-sharing arrangement prioritises the trader, with an 90/10 split allowing traders to retain a substantial 90% of all profits they generate. The firm keeps a modest 10%, underscoring their dedication to putting their traders first.

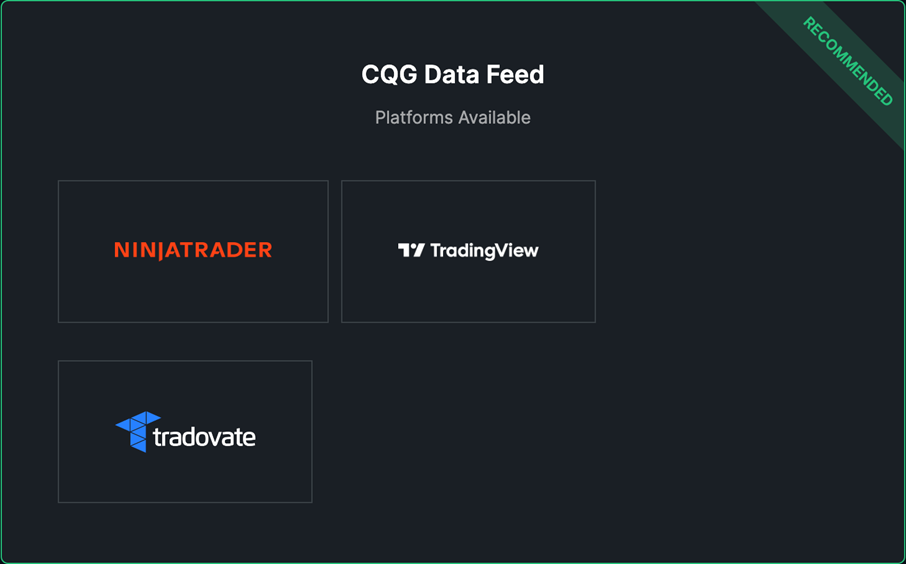

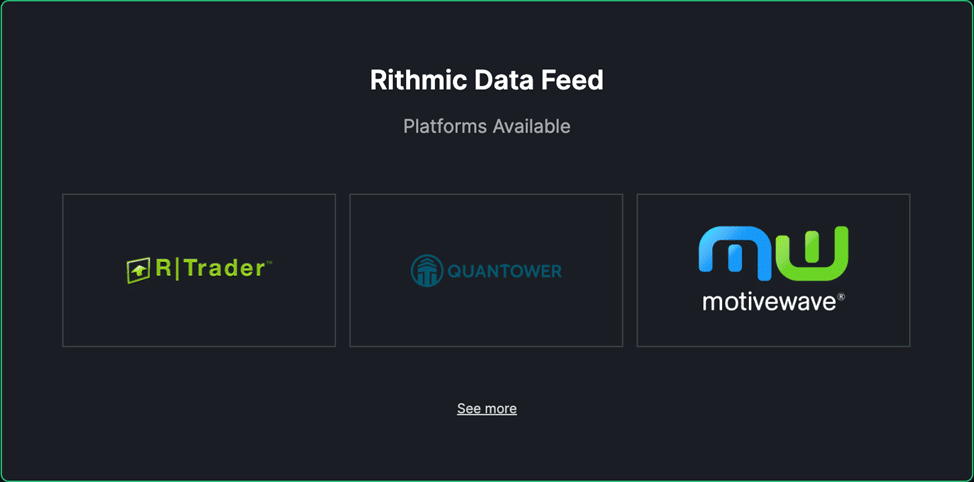

Take Profit Trading provides traders with a choice of over 30 different trading platforms, giving them the flexibility to find one that best suits their needs. For data feeds, the prop firm generally recommends using the CQG Data Feed over the Rithmic Data Feed. Below we list the trading platforms compatible with each data feed:

For CQG Data Feed:

For Rithmic Data Feed:

The range of platforms on offer means there is one to cater to every trading strategy and goal, thereby ensuring that all traders partnering with Take Profit Trader can succeed in trading profitably.

Take Profit Trader allows traders to use multiple Test accounts at one time, and copy trading is permitted on both Test and PRO accounts. However, it’s not possible to trade on more than one PRO account at a time, suggesting that even if you successfully pass multiple tests, only one PRO account will be activated, and the next PRO account won’t be authorised until the first one is lost or cancelled.

When evaluating trading firms, assessing their legitimacy is paramount. Many well-known commercial banks like JP Morgan Chase and Bank of America are restricted from prop trading due to the Volcker Rule. As a result, smaller firms dedicated to prop trading have emerged to fill the void left by larger institutions. Based on the available information, Take Profit Trader appears to be a credible and reputable prop trading, with clearly set out practices and rules that should instil traders with confidence.

Take Profit Trader has over 800 Trustpilot reviews, with an impressive average rating of 4.3 out of 5 stars. Feedback on the firm’s services is overwhelmingly positive, with praise for everything from customer service to prompt and reliable payouts. Although a small percentage of reviews are negative, these are consistently and promptly responded to by the firm, leading to almost all issues being resolved. This serves to further underscore Take Profit Trader’s commitment to the needs of their traders, and that they are always striving to improve the service they offer.

For traders looking to profit from the futures market, Take Profit Trader provides an appealing opportunity. With its wide array of trading instruments and account size options catering to diverse trading capacities, the prop firm stands out as first-rate choice. Despite its current focus solely on futures trading and the absence of features like automated trading and overnight position holding, the firm’s ongoing evolution and dedication to providing traders with immediate returns on their trading efforts set them apart from the competition.

Take Profit Trader offers a comprehensive service and cutting-edge technology at a reasonable cost, making it a worthwhile consideration for traders with a solid strategy and prudent money management practices. All in all, Take Profit Trader could be the ideal partner for traders looking to maximise profits at the same time as reducing risks.

Nonetheless, it’s imperative for traders to carefully research a prop firm before deciding to work with it. As such, as well as considering this overview of Take Profit Trader, traders should also take into account their individual requirements, financial circumstances and appetite for risk to make a balanced decision.

Account size up to:

Overall Rating

Tradeify offers a promising opportunity for aspiring traders to develop their skills and potentially earn profits. The platform’s focus on evaluation and support, can be beneficial for those who are serious about trading.

Apex Trader Funding was founded in 2021 in Austin, Texas by Darrell Martin. The prop trading firm enables futures traders to access funded trading accounts once they have successfully completed an evaluation, known as Evaluation Accounts.

is a futures proprietary trading firm offering prospective traders the opportunity to partake in futures trading without putting their personal capital at risk. Based in Orlando, Florida, the firm provides a wide range of features that distinguish it from other leading prop firms.

TickTick Trader is a fairly new and very exciting proprietary trading firm. It was established in 2022 by a group of trading experts with two decades of experience in the industry.

endeavours to enable aspiring futures traders to take advantage of opportunities in the market while reducing the risks they face along the way.

emerged to address a significant void in the online prop trading sector, a genuine commitment to serving the best interests of its clients.

The Legends Trading prop firm offers a unique opportunity for qualified traders. Through a rigorous evaluation process, Legends Trading identifies skilled individuals and equip them with up to $250,000 in capital.

is a proprietary trading firm providing traders with the opportunity to trade futures using simulated funds, thereby precluding the need to use their own capital and risk losing it.

’s impressive performance has attracted increasing attention to the proprietary trading firm, with ever more traders recommending its funded futures program as one of the best on offer in the industry.

emerged to address a significant void in the online prop trading sector, a genuine commitment to serving the best interests of its clients.

Enter your email to receive this exclusive guide directly to your inbox and gain insights to help you succeed in the futures prop firm industry