Tradeify offers a promising opportunity for aspiring traders to develop their skills and potentially earn profits. The platform’s focus on evaluation and support, can be beneficial for those who are serious about trading.

Tradeify, a proprietary firm, was launched by Brett Simba, a well-known influencer swing and day trader for 6+ years. The firm offers talented traders the opportunity to generate profits using their platform after passing a rigorous evaluation process. This process ensures that traders possess the necessary skills, discipline, and risk management abilities.

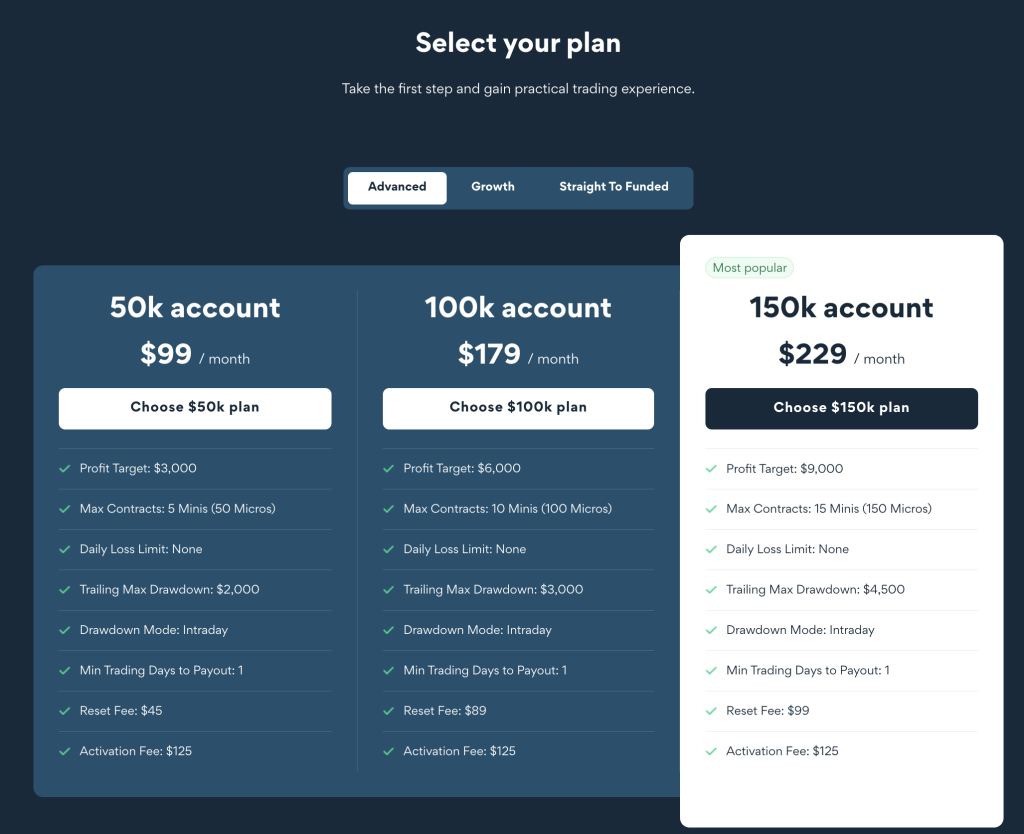

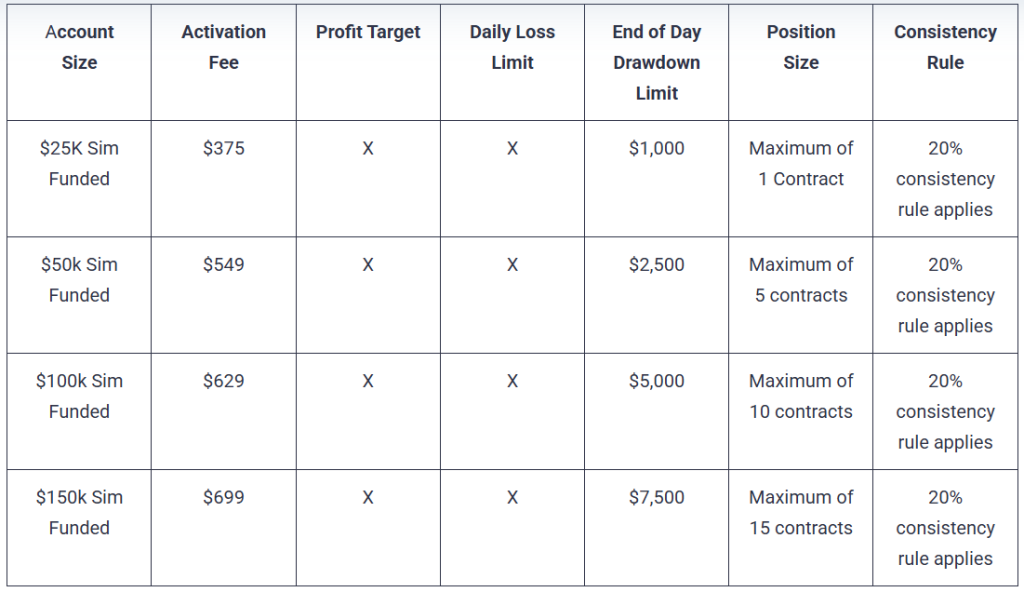

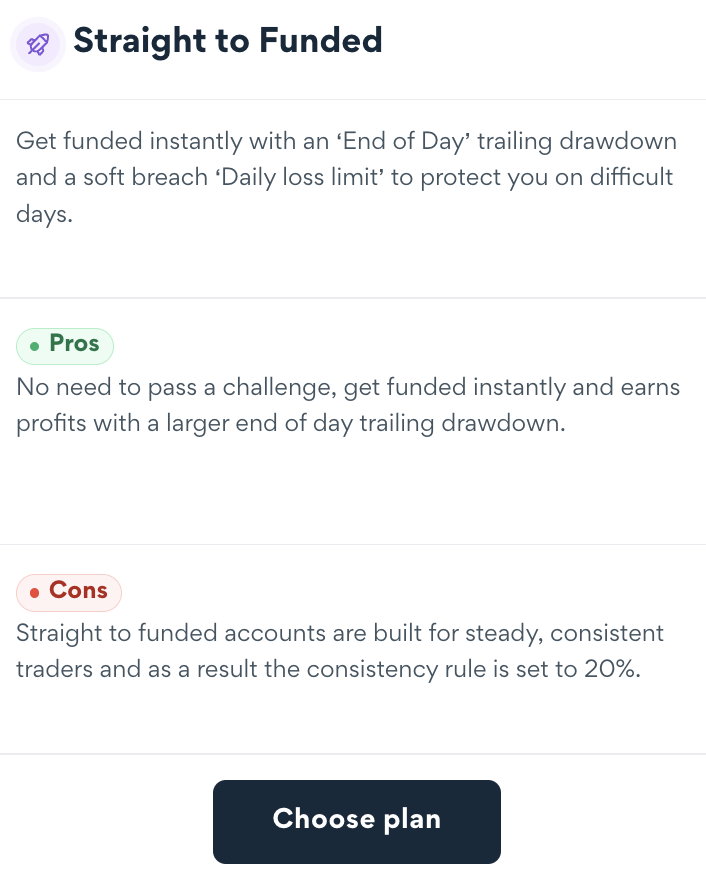

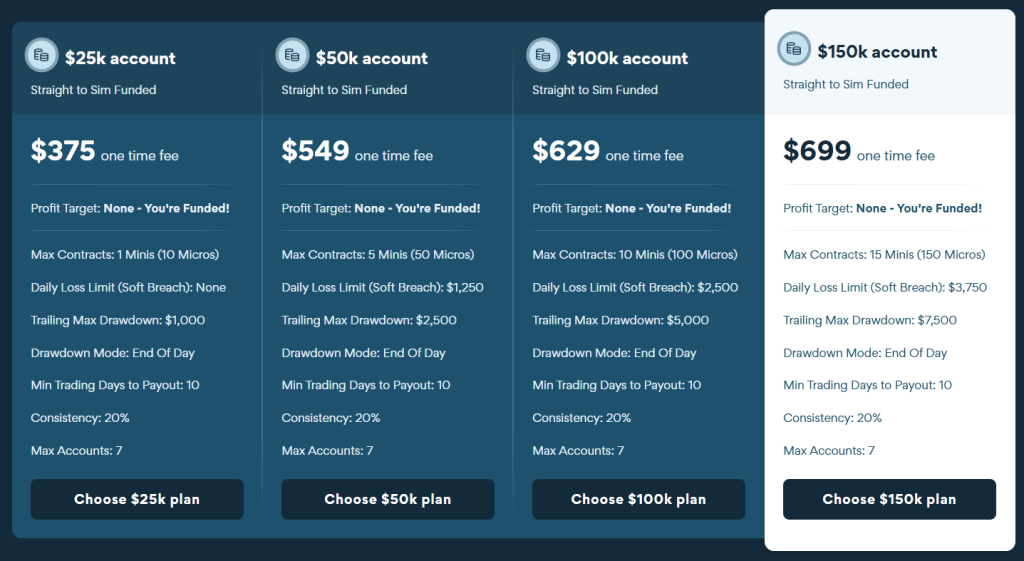

Through the “Advanced” and “Growth” challenges, traders begin with a simulated account to meet specific profit targets while adhering to strict risk management rules. Successful completion of these challenges grants traders access to a simulated funded environment to further confirm their consistency. For those who prefer a more direct path, Tradeify also offers the “Straight to Funded” challenges, providing immediate access to a simulated funded environment to showcase their trading abilities.

Tradeify provides competitive advantages such as access to significant capital, minimized personal financial risk, and dedicated support. Their transparent rules and competitive profit-sharing model are designed to facilitate trader success, allowing them to employ their own strategies while maintaining responsible risk management. With Tradeify, traders are not merely trading; they are building a partnership based on trust and shared success.

A Simulated Funded Account is a trading environment designed to mimic a live trading experience without using real money. It’s especially helpful for new traders transitioning from evaluations to live trading. This account allows you to practice your strategies, manage risks, and build confidence in a real-time setting.

In a Simulated Funded Account, your trades are executed as if you were trading with real money. However, your profits and losses are simulated. This gives you the opportunity to hone your skills and potentially earn real payouts based on your performance.

The Simulated Funded Account serves as a bridge between successful evaluation trading and consistent performance in live markets. It helps you adapt to the psychological and strategic demands of live trading.

Monitoring and Evaluation Tradeify risk managers closely monitor your trading activity in the Simulated Funded Account to assess your ability to follow trading rules, manage risk, and maintain consistency. If you demonstrate successful trading within the account’s parameters, you may be transitioned to a live trading account.

You can have up to 5 Simulated Funded Accounts at a time.

News trading is not allowed on funded accounts. Funded accounts must be flat 2 minutes before and after news releases. This restriction applies only to Tier 1 News. However, traders should always follow their trading systems when trading any news to avoid impulsive or “windfall” trades.

Tier 1 News Includes:

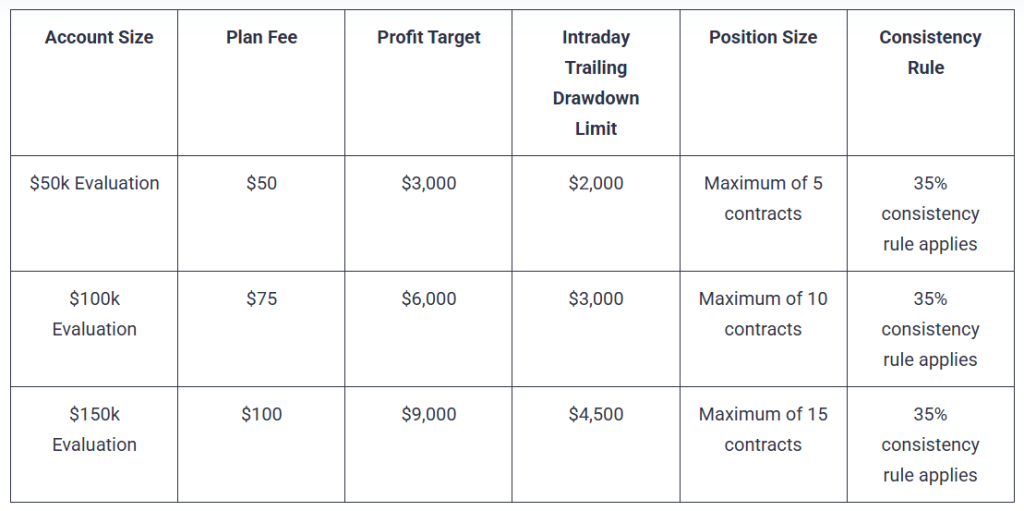

The Advanced Plan features a dynamic drawdown calculation that adjusts in real-time based on your account’s performance throughout the trading day.

The Intraday Trailing Drawdown is a risk management tool used in the Advanced Plan. It promotes disciplined trading by requiring you to lock in profits daily, manage risk effectively, and maintain strict trading discipline.

If your account value increases to $105,000, the drawdown limit will be adjusted to $102,000. If your account value then drops below $102,000 before the end of the day, trading will be halted.

Remember, any remaining drawdown amount at the end of the day will carry over to the next trading session.

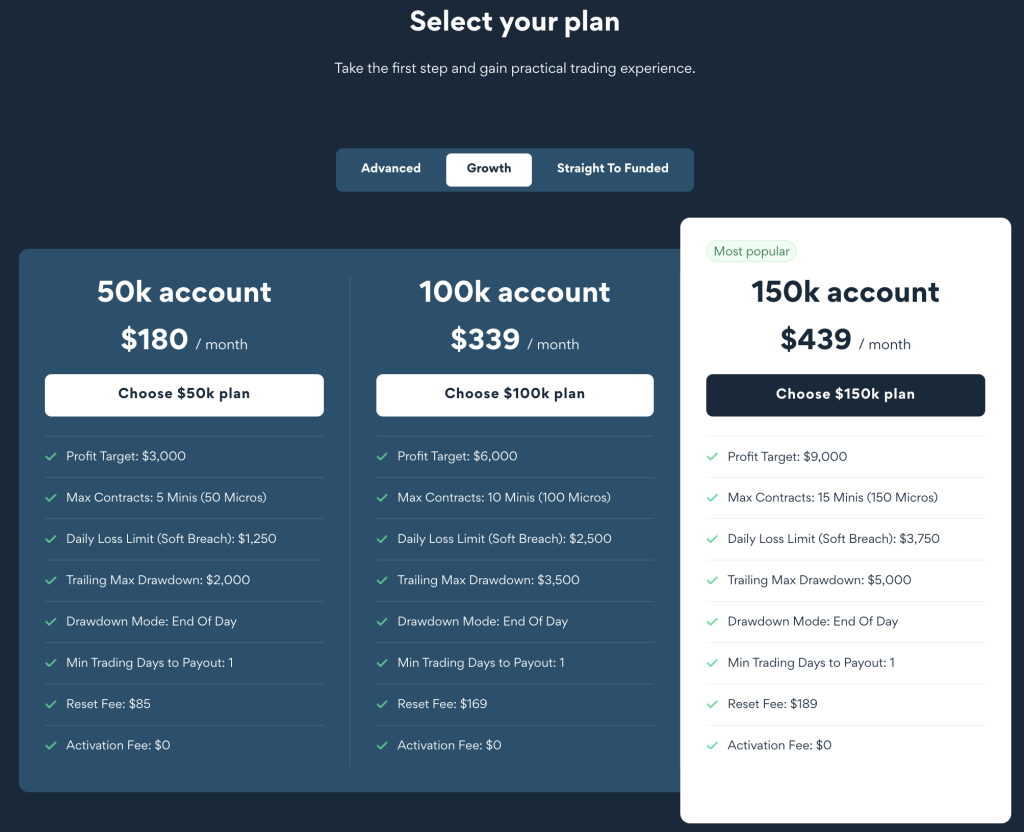

Tradeify Growth Plan features an end-of-day (EOD) trailing drawdown, which is calculated based on the highest account balance achieved at the end of each trading day. This drawdown rule only adjusts downward if your account balance reaches a new high.

The EOD Trailing Drawdown is a risk management tool used in the Growth Plan. It’s designed for traders who prefer to hold trades to their full target or stop-loss without being impacted by intraday price fluctuations.

Tradeify is committed to make futures trading accessible to all. The “Straight to Funded” program offers traders a direct path to trading with the firm’s capital, bypassing the traditional challenge phases. This means eligible traders can start receiving payouts within 10 days of active trading.

To qualify for a Straight to Funded account, traders must demonstrate a 20% consistency rate. This means their trading decisions should align with their overall strategy and avoid impulsive or risky moves. By maintaining consistency, traders can better manage risk, achieve sustainable growth, and align with Tradeify goal of fostering a stable and profitable trading environment.

Congratulations on transitioning to live funds with Tradeify.

Here are the key points you need to know:

Compensation Structure: Traders will receive 100% of the first $15,000 withdrawn. After that, profits will be split 90% to the Trader and 10% to the Company. Unwithdrawn amounts are at risk of loss due to the Trader’s activity. Traders will be paid as independent contractors, not as employees.

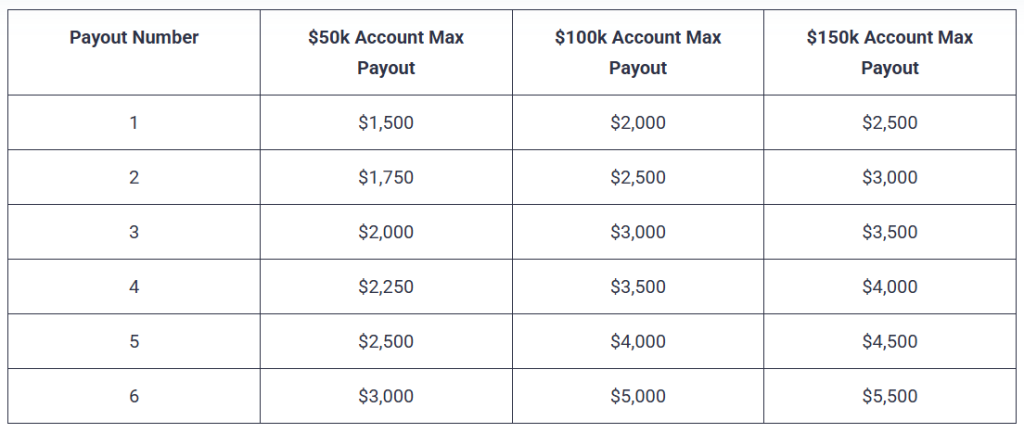

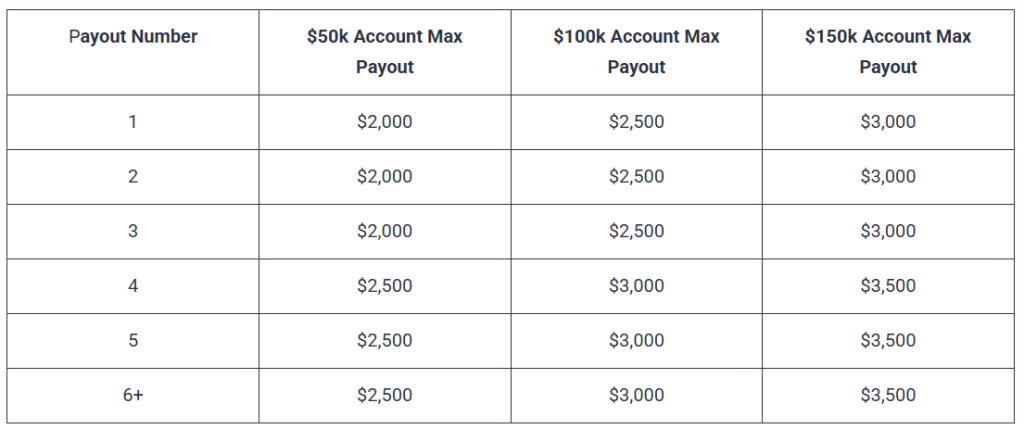

Withdrawal Requests: $50K, $100K, and $150K Advanced or Growth Simulated Funded Account Plans

To request a payout, traders must:

Note: In funded accounts, the maximum drawdown stops trailing when the liquidation threshold reaches $100 plus the initial plan balance. For example, on a $50K plan, the trailing stops when your peak unrealized account balance is the initial plan balance plus the trailing drawdown amount plus $100.

Max payout per payout period (for the first 3 months):

Trade Futures Contracts in one place.

Tradeify offers a promising opportunity for aspiring traders to develop their skills and potentially earn profits. The platform’s focus on evaluation and support, can be beneficial for those who are serious about trading. However, it’s important to consider the potential limitations, such as payout caps and the risk of loss, before deciding if Tradeify is the right fit. Brett Simba, the CEO of Tradeify, has earned a positive reputation, helping to solidify the company’s position as a trusted prop firm.

Account size up to:

Overall Rating

Tradeify offers a promising opportunity for aspiring traders to develop their skills and potentially earn profits. The platform’s focus on evaluation and support, can be beneficial for those who are serious about trading.

Apex Trader Funding was founded in 2021 in Austin, Texas by Darrell Martin. The prop trading firm enables futures traders to access funded trading accounts once they have successfully completed an evaluation, known as Evaluation Accounts.

is a futures proprietary trading firm offering prospective traders the opportunity to partake in futures trading without putting their personal capital at risk. Based in Orlando, Florida, the firm provides a wide range of features that distinguish it from other leading prop firms.

TickTick Trader is a fairly new and very exciting proprietary trading firm. It was established in 2022 by a group of trading experts with two decades of experience in the industry.

endeavours to enable aspiring futures traders to take advantage of opportunities in the market while reducing the risks they face along the way.

emerged to address a significant void in the online prop trading sector, a genuine commitment to serving the best interests of its clients.

The Legends Trading prop firm offers a unique opportunity for qualified traders. Through a rigorous evaluation process, Legends Trading identifies skilled individuals and equip them with up to $250,000 in capital.

is a proprietary trading firm providing traders with the opportunity to trade futures using simulated funds, thereby precluding the need to use their own capital and risk losing it.

’s impressive performance has attracted increasing attention to the proprietary trading firm, with ever more traders recommending its funded futures program as one of the best on offer in the industry.

emerged to address a significant void in the online prop trading sector, a genuine commitment to serving the best interests of its clients.

Enter your email to receive this exclusive guide directly to your inbox and gain insights to help you succeed in the futures prop firm industry